FutureValue has released its latest analysis of FTSE 350 annual reports. Once again, the research shows that most companies can do much better. And they should, because the benefits can be massive. Over the last four years, FutureValue’s index of the best strategic reporters vastly outperformed the FTSE 350 – proof that a good annual report boosts your share price.

How the analysis works

FutureValue marks each report out of ten, across seven areas. Five of these areas are content related – objectives and strategy, performance and KPIs, future factors and risk, strengths and resources, and sustainability. The other two factors are the report’s communication and coherence.

The analysis included 250 of the FTSE 350’s members and looked at reports for years ending between 1 October 2010 and 30 September 2011.

The best reporters outperform

The Strategic Planning Society uses FutureValue’s analysis as the foundation of its Strategic Value in Corporate Reporting Awards.

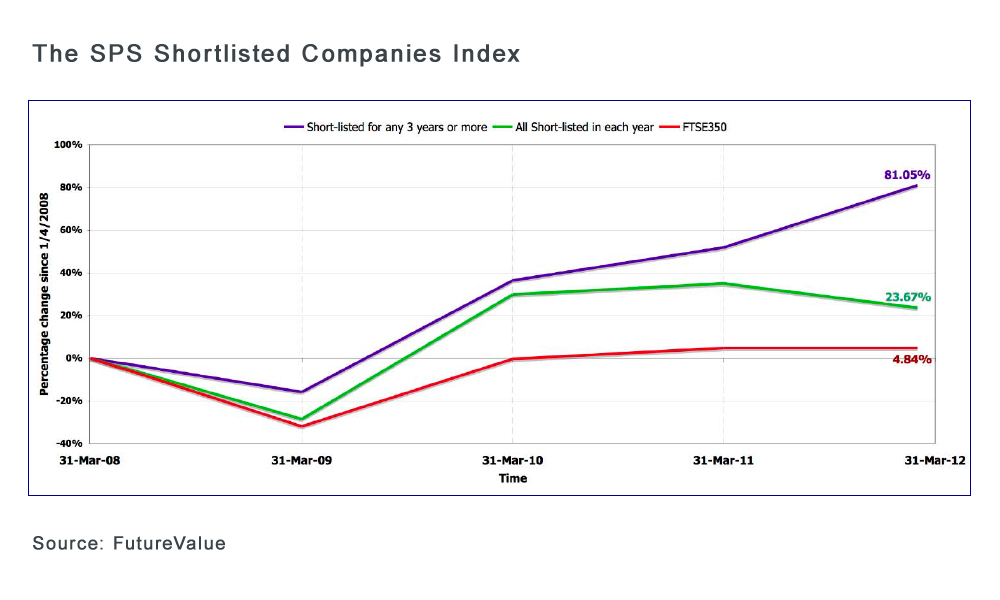

The chart shows how the shares of companies shortlisted for these awards have performed. The green line is an index of the companies that are shortlisted each year, with companies joining the index when they are shortlisted and leaving it the next time they are not shortlisted. The purple line is an index of consistently good reporters that have been nominated at least three years in a row. (One of our annual report clients – Serco Group – is in this category.

The results are clear. Shortlisted companies did well, outperforming the FTSE 250 by nearly 19 percentage points. The consistently good reporters, though, did staggeringly better and outperformed by 76 percentage points.

Why do these companies outperform?

There are several factors at play here.

First, some of the outperformance must be attributable to excellent strategic reporting. These companies should be better understood by the market, increasing the pool of potential investors, making their decision to buy that much easier and providing support when the market turns down.

Second, to be a good strategic reporter, a company has to have a well-thought-out strategy in the first place. These annual reports showcase the quality of management thinking, but they also encourage that thinking. Companies that are committed to transparent reporting put pressure on themselves to think hard about where they’re going and why. They know they need to have something substantive to say, and that they’ll be judged on it.

Third, great annual report content has a wealth of other uses, from investor presentations to the corporate website to management’s spiel in face-to-face meetings. Putting effort into the annual report improves the quality of all your investor communications, reinforcing point 1.

So how are companies doing?

The picture is mixed. There are some excellent reporters out there, as well as some lost causes. In between is a majority of companies that churn out depressingly inadequate reports year after year, when they could do so much more.

Big companies have long done better than smaller ones and that pattern continued this year. The FTSE 100 scored an average of 6.32 out of ten, well ahead of the 5.25 for the FTSE 250. Smaller companies can do well and there are some exemplary reports among the FTSE 250. Overall, though, FTSE 250 companies did worse than last year in almost every area, a clear sign that most do not appreciate the benefits of good reporting.

The area with the lowest scores was objectives and strategy, reflecting the fact that it needs the most thought to get right. The FTSE 100 scored 5.5, while the FTSE 250 limped in with a dismal 4.4, down from 4.8 last year. Business models are part of the problem here. Many companies seem not to understand their business model, although this is a relatively new reporting requirement and standards should improve over time.

The best marks are for communication (FTSE 100: 7.0, FTSE 250: 6.2) and sustainability (7.0 and 5.6 respectively). Companies have focused on improving their sustainability reporting for several years. Compared to objectives and strategy, it’s a relatively easy area to score well in.

What’s the conclusion?

Effective strategic reporting is well worth the effort. Most companies have a real opportunity to do better and they should grab it with both hands.

Lack of resource is undoubtedly an issue for many FTSE 250 companies, and that’s where having the right partners comes in. Use a design agency that understands corporate reporting and a specialist copywriter who can create the words and advise you on content and messaging.

Ultimately, of course, it’s up to companies to think harder about their strategies. Good strategic reporting depends on good strategic thinking.

Find out more

Read about our annual report copywriting and corporate reporting consultancy services. Or contact us to discuss your needs.

Check out our top tips for improving your annual report.